This episode Chaz (welcome to the wall) and I talk about 401K info and what should a person look at when they are choosing a plan as well as when and how they should do it. We touch on roll over as well as IRA and ROTH IRA options when you lose or quit a job you have had a 401K established. Here's some IRA data:

- IRAs can be opened by anyone who works or has a working spouse. There are two kinds of IRAs: a traditional IRA and a Roth IRA.

- Traditional IRAs let you deduct taxes now and pay them later; with a Roth IRA you pay income taxes now but are not taxed when you withdraw from them.

- Traditional IRAs allow you to save up to $5,500 per year ($6,500 if you are 50 and older) and deduct eligible contributions from your income tax. The same is true for Roth IRAs, but contributions are disallowed at higher income levels.

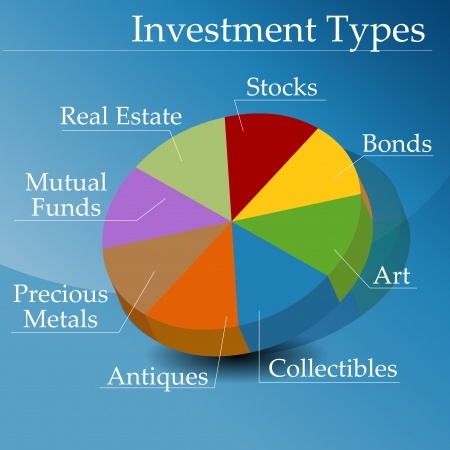

- You can invest in many different kinds of stocks, bonds, mutual funds and other investments within an IRA. You typically open an IRA at a brokerage or a bank.

401 K info for the employed:

- A 401k is a qualified retirement plan that allows eligible employees of a company to save and invest for their own retirement on a tax deferred basis.

- Only an employer is allowed to sponsor a 401k for their employees. You decide how much money you want deducted from your paycheck and deposited to the plan based on limits imposed by plan provisions and IRS rules.

- Your employer may also choose to make contributions to the plan, but this is optional.

We start off with a new segment we have haven't decided what to call it yet (that's bullshit, or unchallenged Myth's) talking about things people ask without real answers to.