Part two of with our special guest Justin Fontenot. We jump right into the current day issues with cyber security. We get the direct advise from a Cyber security professional that gives us insight on what companies are doing as well as our misconception of what the government is doing with cyber security currently.

Millennial Talk with Justin Fontenot (Cyber security)

Chaz and I welcome our special guest and Millennial Justin Fontenot. A cyber security manager that came from humble beginnings to overcome those obstacles and began achieving his goals with a well structured plan to be successful. Alicia joins us to add color and her perspective to the IT issues occurring now. An amazing story that will inspire many

Millennial Talk with Chaz Jenkins Part II

On our part two of our interview with Chaz, He goes into some of the procedures he went through to prepare, evaluate and execute his plans to move his career forward. Insightful suggestions and real life scenarios that people can relate to that will keep you ready for your next move to a new job or career.

The first of a two part series of millennials that went through different hardships during their younger years to get to a point in their life to make a decision about their future. Financial and academically.

Millennial Talk with Chaz Jenkins

On this episode, Chaz takes us down his path and obstacles to get to his point in his life currently. He takes us through the process and transition from employed to unemployed to being employed again. A great Segway to starting our series of millennials that went through different hardships during their younger years to get to a point in their life to make a decision about their future. Financial and academically.

Life insurance with Super Agent Jeremy Goodrich Part 2

On part two of our sit down with Insurance guru Jeremy Goodrich. We go a little abstract out side of life insurance and ask a few different insurance questions that effects us all. Jeremy shocks us on things that if you aren't really experienced insurance person you would be stumped. Follow Jeremy on the following platforms:

Shine insurance agency

Shine insure.com

Shineinsure: twitter

Shine insure: instagram

Shine Insurance Agency: Facebook

Podcast:

Scratch entrepreneur.com

Itunes podcast

youtube podcast

Life insurance with Super Agent Jeremy Goodrich Part 1

This episode Chaz and I welcome a special guest to speak about the unsexy life of insurance. We were approached by a member of the welcome to the wall crew, and asked, what are good options for life insurance as a young millennial. Chaz and I reached out to super agent Jeremy Goodrich from Shine insurance to fill us in on the unsexiness of insurance and what we don't know and what we should know. We discuss options with Life insurance, investments and the little things we missed without talking to an expert.

Term Life - Term pays only if death occurs during the term of the policy

(1 - 30 years)

Whole Life - Whole pays a death benefit whenever you die. even if you live to 100

Universal Life - UL the excess of premium payments above the current cost of insurance

is credited to the cash value of the policy

Variable Universal Life - VUL is a permanent life insurance policy with an investment component. The policy has a cash value account, which is invested in a number of sub-accounts available in the policy.

Financial advice from Latoya Mixon

Chaz and I have a very informative conversation with a financial expert and Howard Alumni and give us a good perspective at finances and how African Americans have the ability to make good financial moves but fail to educate themselves or listen. Rachel joins us once again, but we have to get her own mic next time

Strip Clubs, Finances and the psychology of the young millennial

Tonight Chaz and I welcome some special guest to M3 to discuss the popular to some and controversial to others Strip Club entertainment. With the huge cost to some people frequenting these establishments, we wanted to sit down and talk to a couple with a different perspective.

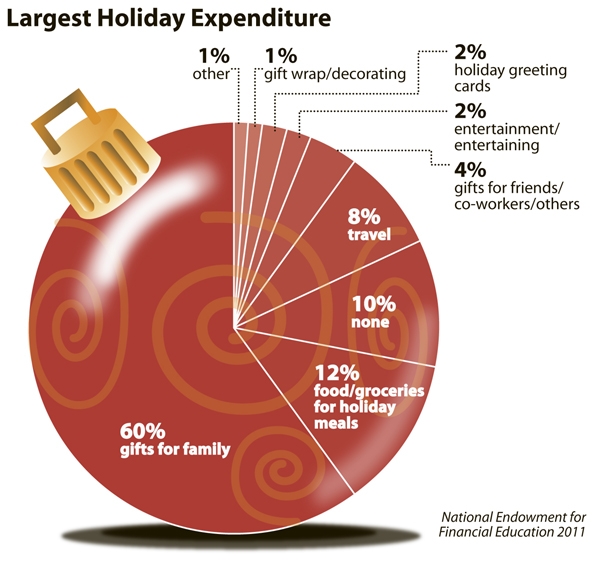

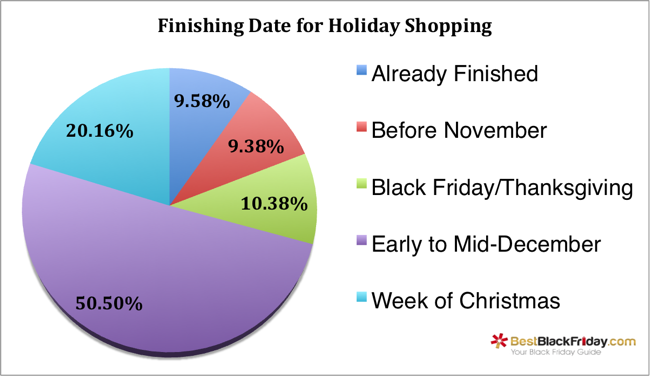

M3 Holiday spending and holiday obligations

We end the year with how spending around this time is so stressful because of ignorance, obligations or just commitment. We kinda give some ideas when and why spending should be smart, strategic and needful. Also the dumb commitment of New Years resolutions. Is there a good way of following goals other than national holidays? We use our myth buster segement to relate to the Origins of New years resolutions from further back than most would imagine.

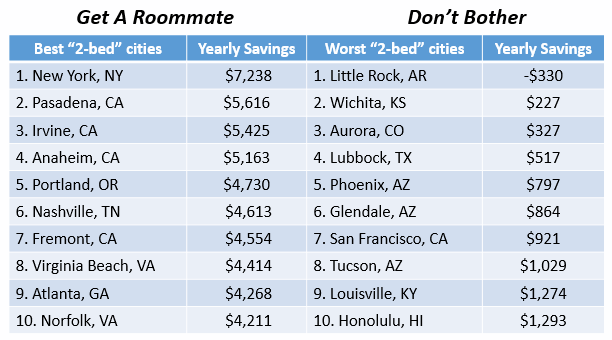

M3 recap (roommates)

This episode we touch on the roommate issue from the last episode and we get to discuss this weeks Myth busters. This weeks myths buster is all about healthy foods.

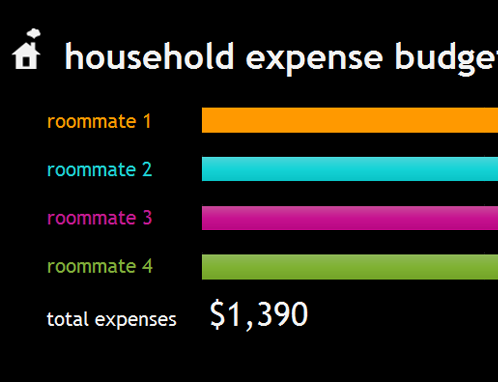

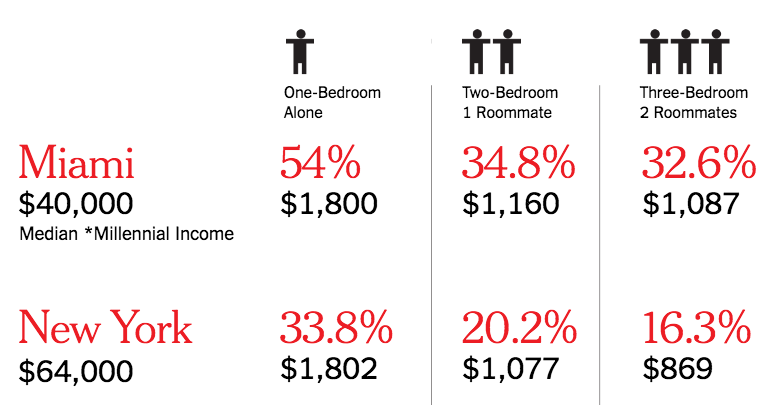

Home budgeting with multiple roommates

This episode of M3 Chaz and I join another member from the "Welcome to the Wall" crew to discuss a smart and ambitious investment of owning a home together. We talk budgeting and how to separate cost within one household. Good talk for anyone entertaining roommates.

Smart Phone options and tech talk

This episode of M3, Chaz and I talk about the high cost of the two popular "Smart Phone" makers and why you should look at others based on price and breaking away from the status quo. We bring back our Myth busters and talk about our experience with tech and how it effects us.

401K and other tips

This episode Chaz (welcome to the wall) and I talk about 401K info and what should a person look at when they are choosing a plan as well as when and how they should do it. We touch on roll over as well as IRA and ROTH IRA options when you lose or quit a job you have had a 401K established. Here's some IRA data:

- IRAs can be opened by anyone who works or has a working spouse. There are two kinds of IRAs: a traditional IRA and a Roth IRA.

- Traditional IRAs let you deduct taxes now and pay them later; with a Roth IRA you pay income taxes now but are not taxed when you withdraw from them.

- Traditional IRAs allow you to save up to $5,500 per year ($6,500 if you are 50 and older) and deduct eligible contributions from your income tax. The same is true for Roth IRAs, but contributions are disallowed at higher income levels.

- You can invest in many different kinds of stocks, bonds, mutual funds and other investments within an IRA. You typically open an IRA at a brokerage or a bank.

401 K info for the employed:

- A 401k is a qualified retirement plan that allows eligible employees of a company to save and invest for their own retirement on a tax deferred basis.

- Only an employer is allowed to sponsor a 401k for their employees. You decide how much money you want deducted from your paycheck and deposited to the plan based on limits imposed by plan provisions and IRS rules.

- Your employer may also choose to make contributions to the plan, but this is optional.

We start off with a new segment we have haven't decided what to call it yet (that's bullshit, or unchallenged Myth's) talking about things people ask without real answers to.

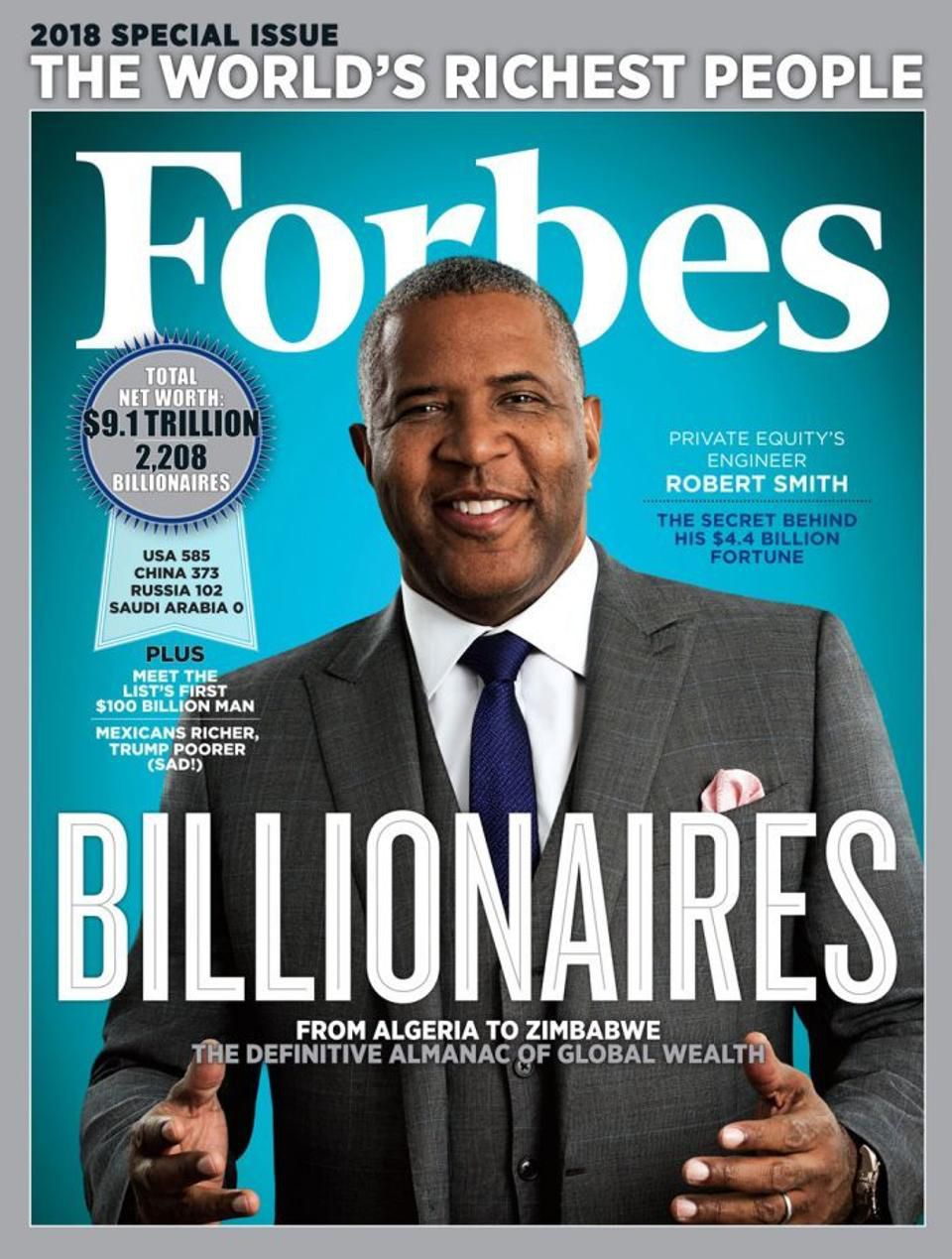

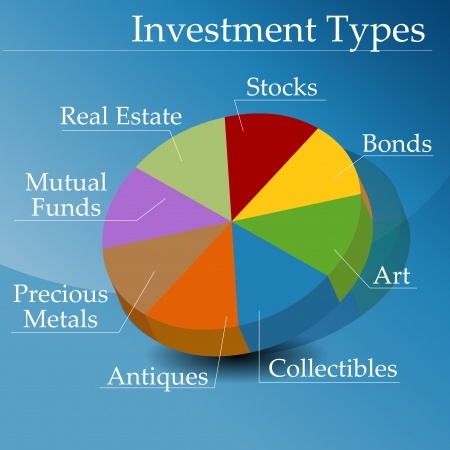

Investment Options for the Millennial

Tonight Chaz and I discuss investments people can look at as an alternative to savings accounts. We discuss stocks, mutual funds, money markets, CD's and just options other than sitting your money in an account that will only give you less than 0.5%. Some of the Welcome to the wall crew joins us to discuss financial options early in their life.

From the Hood to Middle Class redux

Today Chaz and I return to our financial series with revisiting plans we helped Jermey with on our last Financial episode. The major long term goals we had Jermeey addressing were A new bank account, a credit card and what would be his new living arrangement (purchase and renting). We get something totally unexpected but hold on to hope that our advice would not fall on deaf ears.